Topic of the month February 2017: Climate Change Risk in Sovereign Bond Investments

Climate Change Risk in Sovereign Bond Investments

Despite US threats to withdraw from the historic Paris climate agreement, momentum continues to build globally for carbon risk disclosure and management in the investment community. According to Moody’s, widespread adoption of the agreement and the coordinated actions of governments to reduce carbon emissions over time has “the potential to become a significant ratings driver in a broad set of industries.” While carbon disclosure on the part of investors has been focused almost entirely on equities, and to lesser extent corporate bonds, investors with sovereign bond holdings are coming to realize they also face carbon risk exposure.

The sovereign bond market is one of the largest asset classes, representing a remarkable $21 trillion in outstanding debt by national governments. Further, sovereign bonds typically represent a significant percentage of diversified investment portfolios, especially among institutional investors. But the lack of clarity on methodological approaches has been a major obstacle for assessing climate risk in sovereign bonds.

To address this gap, Global Footprint Network and South Pole Group convened a group of nine asset owners and managers* to examine the methodological issues involved and develop a set of recommendations, which are laid out in a new report: Carbon Disclosure and Climate Risk in Sovereign Bonds.

As described in the report, climate risk at the country level is multi-faceted, but a comprehensive dashboard to manage investment risk can be organized as part of three key elements:

• Carbon exposure or “transition risk”, including dependence on fossil fuel reserves and the carbon intensity of the economy;

• Physical climate change risk, including a country’s exposure to extreme weather events, water scarcity, and food price shocks; and

• A country’s policy response including its adherence to climate agreement pledges (Nationally Determined Contributions, or NDCs)

Transition Risk: The Carbon Intensity Approach

Methodologies for carbon disclosure in equities, ranging from ownership-based carbon footprints to carbon intensity metrics, may be adapted to sovereign bonds. However, a number of potential distortions make certain methodologies, particularly those that rely on debt outstanding, less suitable for sovereigns. The intensity approach, on the other hand, has many compelling advantages: It is scalable, comparable, and provides insight into investment risk exposure.

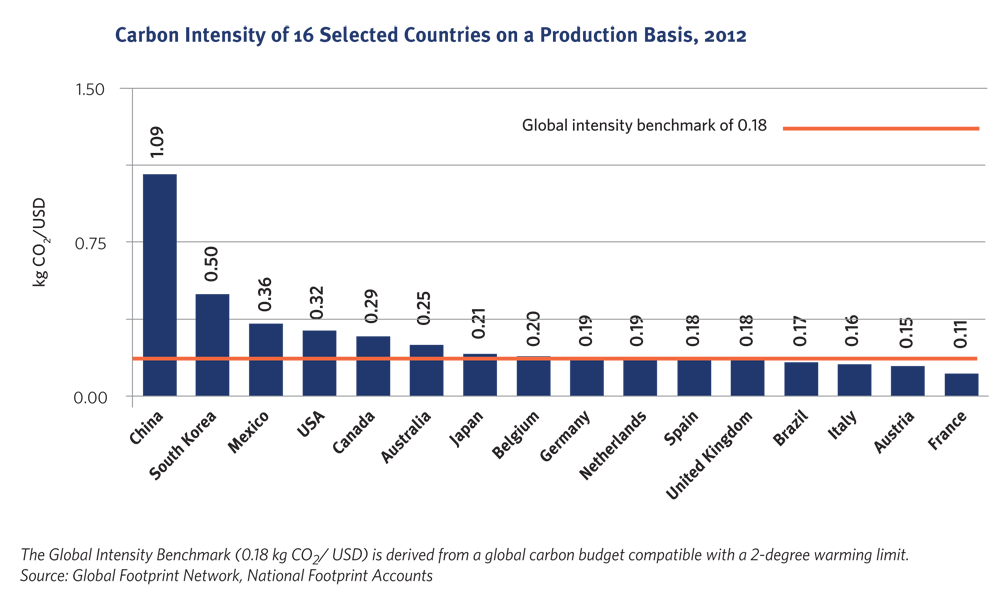

This approach also answers the questions: “How carbon intense or efficient are the entities in which we are investing? How much carbon is emitted per unit of GDP?” The carbon intensity of a portfolio can then be calculated by averaging the intensities weighed by each bond holding’s position within the investor’s total portfolio.

A large number of national economies depend heavily on carbon-intensive sectors. Staying below the 2-degree warming limit recommended by scientists will require deep and rapid changes to the economic structures of many, if not all, countries. Countries with high carbon intensity, regardless of their level of debt outstanding, can, therefore, be considered to be exposed to greater risks related to the transition to a carbon-constrained economy.

If a country fails to plan for this transition, its fiscal situation, trade balance, or even overall employment and growth prospects could deteriorate due to a number of factors such as increased costs, competition, as well as asset stranding as carbon-intensive assets become obsolete.

On the flip side, proactive countries are getting ahead of these trends by investing in low-carbon alternatives and positioning themselves to take advantage of the opportunities of a new energy economy. Consider the case of the United Arab Emirates: A top oil producer, the UAE has set itself apart from other Middle Eastern neighbors by making major investments to fulfill an ambitious vision for a clean energy future.

Physical Climate Change

These structural changes come on top of the more widely recognized weather-related risks of climate change, which affect some nations disproportionately simply due to their geographical location. S&P Global Ratings has called climate change a “global mega-trend for sovereign risk.” In its report “The Heat Is On: How Climate Change Can Impact Sovereign Ratings,” S&P concluded the ratings of many emerging sovereigns, specifically in the Caribbean or Southeast Asia, would likely come under additional pressure as a result of climate change. Similarly, Moody’s released a report in November saying countries' creditworthiness could be increasingly affected by climate change, with African and South Asian sovereigns most susceptible to the economic effects of global warming,

Growing Regulatory Momentum

Meanwhile, regulatory momentum is growing for more carbon risk disclosure. In December 2016 the Financial Stability Board’s Task Force on Climate-related Financial Disclosure issued recommendations calling for carbon risk disclosure as part of a company’s public financial filings. This information is needed by investors including banks and insurance companies to be able to assess climate risks and opportunities so that they can be priced accurately. Supporting appropriate capital allocation decisions is one of the key functions of the financial markets. Given that transition risks also exist at the country level, it can be easily argued that investors similarly need to understand the climate risks associated with sovereign bond holdings.

*The carbon disclosure recommendations for sovereign bonds were developed in collaboration with a working group that included Aegon Asset Management, Alliance Bernstein, BlackRock, BT Pension Scheme, DEGROOF Petercam, MN, Swisscanto Invest, Nippon Life Global Investors, and Vontobel.

For more on the latest findings on climate risk in sovereign bonds:

● “Carbon Disclosure and Climate Risk in Sovereign Bonds”, a new report by Global Footprint Network in collaboration with South Pole Group, outlines a methodology for investors to disclose and manage carbon exposure in their sovereign bond holdings.

● A webinar explores the key findings of the recently published report.

● A webinar explores the key findings of the recently published report.

Author:

Author:

|

About South Pole Group South Pole Group is one of the world’s leading climate action solution providers, measuring and reducing climate impact for its clients. Headquartered in Zurich, Switzerland, with offices around the globe and over 150 climate change professionals, the company has achieved savings of over 50 million tonnes of CO2 since being incorporated in 2006. The company pioneered high volume portfolio carbon screening that is now available on Bloomberg terminals (APPS CARBON), YourSRI.com and CleanCapitalist.com. South Pole Group has been a key contributor to the Montreal Carbon Pledge. About Global Footprint Network Global Footprint Network is a research organization that is changing how the world manages its natural resources and responds to climate change. Since 2003, the organization has engaged with more than 50 nations, 30 cities, and 70 global partners to deliver scientific insights that have driven high-impact policy and investment decisions. Global Footprint Network’s Finance for Change Initiative was launched to more deeply analyze and expose the links between climate change, resource constraints, economic performance, and sovereign credit ratings. |