Topic of the month January 2017: How ESG integration adds value to our investment process

How ESG integration adds value to our investment process

The path to an integrated ESG approach

The Vontobel mtx approach on integrating ESG (environmental, social and governance) considerations into the investment process has been an evolving process. Back in 2009 when we first started looking at sustainability aspects in a systematic way, the team followed a screening approach where exclusion criteria played an important role and brought the team close to a best in class setup. This ESG approach, while bringing valuable insights into the investment process, did not provide the expected results and was not feasible from a portfolio construction point of view. Thus, as we continued to develop and refine our overall investment process and tools, we did the same for our ESG process.

In 2010 the decision was made to integrate ESG analysis directly into the evaluation of companies, based on our conviction that it plays an integral part in the future returns achieved by a company. As the goal was not to separate ESG from the financial analysis, the financial analysts had to build up their ESG knowledge. This was achieved through to the close collaboration with a team of ESG specialists within Vontobel Asset Management. We found that our approach to integrating ESG within our investment process adds additional value for our investors.

The Vontobel mtx Minimum Standards Frameworks

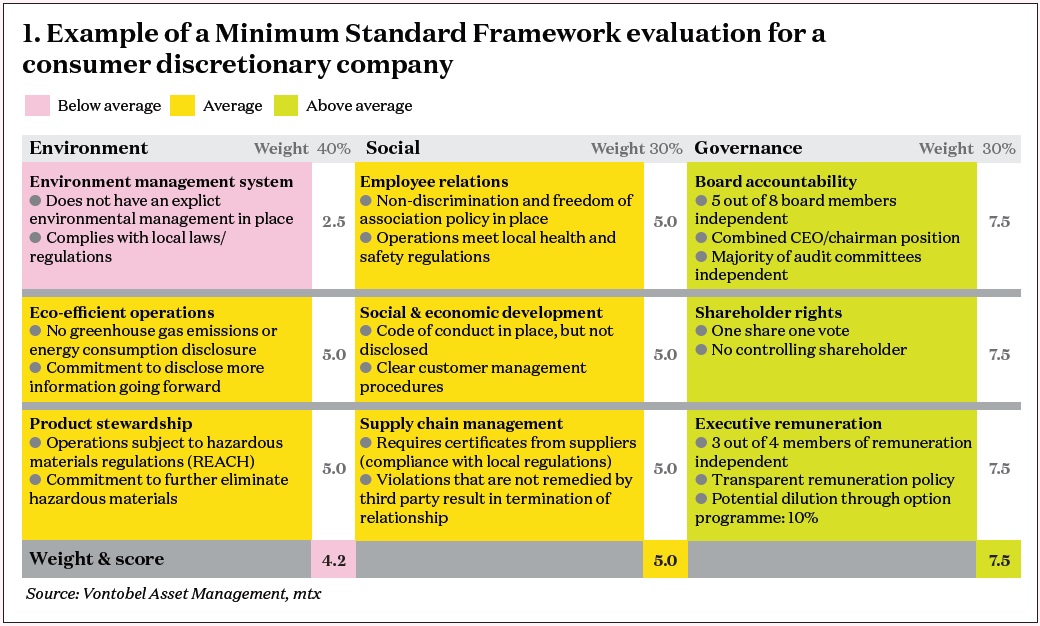

This collaborative partnership was the basis for the development of our industry specific sector reports, where our financial analysts identified and summarised challenges and opportunities for each sector that are expected from a changing world and its implications for decisions in ESG-related issues. These ESG research reports serve as the basis for defining the proprietary sector-specific Minimum Standards Frameworks which are at the core of our ESG analysis. The Vontobel mtx ESG approach focuses on issues that are relevant for the industry where the company operates and which might influence future cash flows. As such, it is not a “one size fits all” approach and each company is assessed on a case-bycase basis. The Minimum Standards Frameworks drive the decision-making process, adding consistency and discipline to a subjective area. As shown in figure 1, in total, a minimum score of five on a scale from zero to ten is required for a company to be eligible for the portfolio.

We consider our integrated ESG approach through the Minimum Standard Framework assessment as a risk management tool. Given that a significant amount of ESG information is qualitative in nature, we judge it appropriate to undertake a qualitative assessment. The same framework is used for developed and emerging markets with the aim of improving the risk-return profile of investments.

Our ESG research process

Core to our ESG research process is that the sector analysts synthesise their own analysis with the qualitative and quantitative inputs received from external sustainability research providers, which is then used to form a view on the issues that are most likely to impact cash flows and, therefore, the investment case for a company. Our own experience shows that external sustainability research is often backward looking and tends not to include information on future initiatives when it comes to ESG matters and how the companies tackle them.

The specific challenges of ESG in emerging markets

A particular challenge for emerging markets is that research from external research providers is more difficult to obtain. As a consequence, our analysts tend to do more proprietary research for emerging market companies when it comes to ESG in order to be able to make a proper assessment of the potential investment targets. This means that the analysts enter into direct dialogue with specific companies (if needed, using translators) to get the information necessary regarding the criteria to be evaluated as defined in the sector specific Minimum Standards Frameworks. Experience shows that this direct engagement with companies enables us to get crucial information that would otherwise not be possible. In fact, companies often show interest in our views on where there is room for improvement and what stakeholders are looking for when it comes to ESG-related company information and data.

These conversations and information, besides creating greater awareness of the importance of ESG issues, also serve as a basis to judge the progress a company achieves over time.

When selecting an ESG integration approach, an independent audit is important. At Vontobel mtx, an ESG professional not otherwise involved in the investment process ensures that the Minimum Standard Framework scores as determined by the investment analysts are a true reflection of a company’s ESG performance. This ESG professional’s assessment is completely neutral and made independently of a potentially strong investment case.

Our process benefits from several support layers of expertise within our organisation. The ESG Investment Committee gives sustainability guidance at the asset management level. In addition, the group sustainability strategy is set at the Vontobel Sustainability Committee. These structures embed the sustainability work of the mtx boutique in a strong network of ESG expertise.

The role of ESG in our investment process

There are four key pillars to the Vontobel mtx investment process, one of which is ESG. For a company to be eligible for investment, however, each of the following four prerequisites must be met:

▪▪ Profitability

The company has to have delivered consistent, above-average returns on invested capital in the past. This is based on empirical evidence, which suggests that the relative level of profitability matters for the returns of stocks, i.e. companies with a high level of returns on invested capital outperform those with low level of returns through the market cycle.

▪▪ Industry position

A company that is well positioned within it industry is more likely to reinvest free cash flow in superior growth projects, enabling continued growth and – as a result – maintaining above-average returns in the future. Typically, superior profitability is persistent over a longer time than the market expects.

▪▪ Intrinsic value

The company must have an attractive valuation offering a margin of safety to a company’s intrinsic value as estimated by our analysts. This ensures that we buy at attractive levels, as the entry point (and thus the entry point valuation), is a significant factor in determining the rate of return of an investment.

▪▪ Sustainability

As addressed previously, the company’s management team must demonstrate leadership with regards to effectively addressing ESG issues. We believe that strong cash generation ultimately drives equity performance. Incorporating the effective management of ESG issues is becoming increasingly important for companies in order to maintain industry leadership and strong financial performance.

Measuring the value of our ESG approach

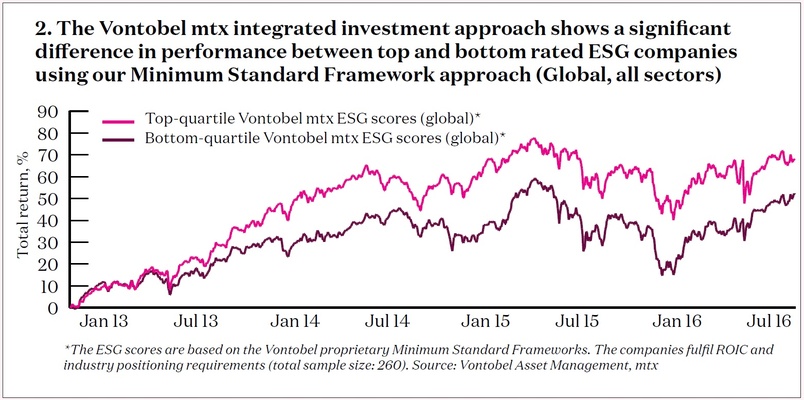

Vontobel mtx has been applying this proprietary framework for ESG assessment since 2010. After being in place for several years, the team wanted to gain a better understanding of the value of the ESG assessment methodology. In order to do this, we tested our global Minimum Standard Framework scores across all sectors and compared companies which qualify from a ‘Return on Invested Capital’ basis and an ‘Industry Positioning’ perspective, but with differing ESG performance. The analysts compared the stock price development of the basket of top-quartile ESG companies according to our assessment (equally-weighted) with the performance of the basket with bottom-quartile ESG companies for the period between December 2012 (the launch of the Vontobel mtx Sustainable Global Leaders Fund) and September 2016 on a global basis. The results show that companies with high Minimum Standard Framework scores (equals strong ESG performance) outperformed companies with low Minimum Standard Framework scores (equals weak ESG performance). This theoretical outperformance (Figure 2) indicates that the defined Minimum Standards Frameworks, and therefore how ESG is integrated into the investment process, provides important additional information for the evaluation of a company and can be a considerable value-adding factor in the process.

We believe that most investors are unwilling to accept a trade-off between performance and taking ESG considerations into account. The Vontobel mtx approach shows that one does not exclude the other and that ESG integration can actually improve returns.

Integrating ESG considerations in emerging markets portfolios is especially valuable

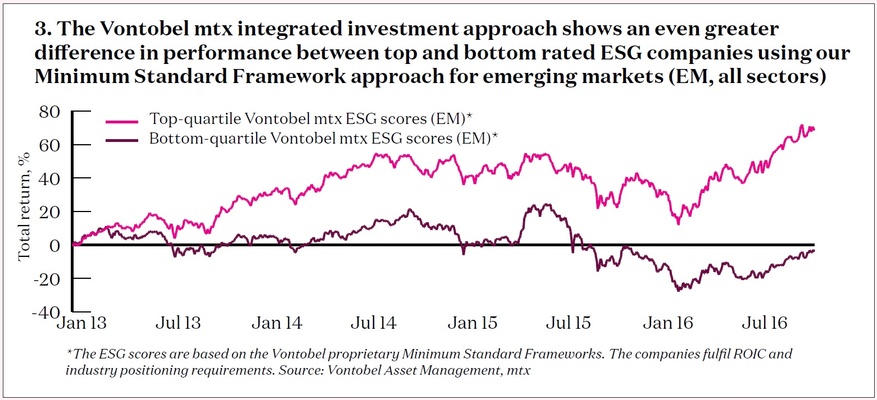

As an interesting comparison, the performance for the same period was calculated for the basket of top-quartile Minimum Standard Framework companies versus the performance of bottomquartile Minimum Standard Framework companies, this time including only emerging markets companies. The results (Figure 3) show that for emerging markets the result is evenmore striking, meaning the described ESG integration approach adds even more value in emerging markets. This result seems to support the thesis that taking ESG considerations into account in the investment decision process can add even more value in emerging market compared to developed markets.

Conclusion: ESG confirmed as an important factor in the investment process

The evidence and our experience shows that the proprietary sector-specific Minimum Standards Framework developed by Vontobel mtx analysts is an important part of the investment process, helping to identify attractive investments and create long-term value for investors.

*Important legal information: This is the personal opinion of the author and does not necessarily reflect the opinion of Vontobel Asset Management.

Author: |

About Vontobel Asset Management/mtx Boutique The mtx boutique is part of Vontobel Asset Management and responsible for managing CHF 1.7 billion across a range of equity strategies. The team is located in Zürich, Switzerland, and comprises 11 investment professionals who focus on investing in leading businesses with high and growing profitability. The team has an average industry experience of 15 years in both traditional and sustainable investment. In our investment philosophy we believe that the primary driver of investment returns is corporate profitability, measured by how well a company generates cash flow relative to the capital it has invested in its business, i.e. return on invested capital (ROIC). Companies with consistently high ROIC and strong competitive positions are more likely to reinvest their free cash flow in superior growth projects, enabling continued growth and sustaining above-average returns in the future. We further believe that the market tends to underestimate these companies’ ability to sustain their profitability and thus their future cash-flow growth, which presents an investment opportunity as we can buy these companies at a discount to intrinsic value. Last but not least we are convinced that effective management of Environmental, Social and Governance (ESG) issues is increasingly important for companies to maintain industry leadership and strong financial performance. www.mtx-am.com |