Retail Automation: Stranded Workers?

Executive summary

The retail landscape is experiencing unprecedented change in the face of disruptive forces, one of the most recent and powerful being the rapid rise of automation in the sector. The World Economic Forum predicts that 30-50% of retail jobs are at risk once known automation technologies are fully incorporated. This would result in the loss of about 6 million retail jobs and represents a greater percentage reduction than the manufacturing industry experienced. Using Osborne and Frey study1 with the Bureau of Labor Statistics, the analysis suggests that more than 7.5 million jobs are at high risk of computerization. A large proportion of the human capital represented by the retail workforce is therefore at risk of becoming “stranded workers.”

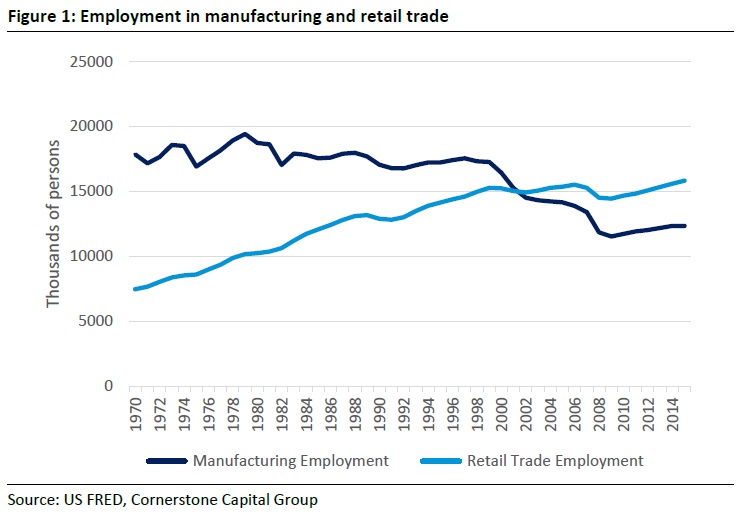

As of 2002, retail employment exceeded total manufacturing employment, and now sits at about 16 million workers (Figure 1). Total manufacturing employment, which peaked in 1979 at approximately 19 million workers, has fallen to 12 million workers. The repercussions of manufacturing’s decline, which was driven by automation and globalization, have been felt at the local and national levels. For example, certain areas of the US that were once manufacturing hubs have experienced rising poverty, declining populations, and erosion of political trust.

The impact of significant reductions in retail workers may mirror the impact of manufacturing job losses. Retail sales at brick-and-mortar stores, as well as margins on those sales, are increasingly constrained as consumers shift to online shopping. At the same time, many parts of the country are experiencing upward structural wage pressure as concerns about income inequality are gaining political traction. Major retailers, including Macy’s, J.C. Penney, Kohl’s and Wal-Mart, have collectively closed hundreds of stores over the last few years in attempts to stem losses from unprofitable stores. These headwinds are pushing retailers to rethink the traditional retail business model.

Retailers are investing in technology to build out their omnichannel platforms. In some cases, technology is complementing labor by providing a better customer experience. Indeed, this report argues that companies which use technology to support their workers are likely to benefit from long-term productivity gains. However, technology also has the potential to automate part of the sales process and render a range of jobs redundant. Taken together, store closures and automation technology have the potential to accelerate job losses in retail, an industry that employs approximately 10% of the total US labor force.

An in-depth examination of retail automation was undertaken to enable investors to consider investment risks and opportunities by exploring how retail is addressing profit pressure and how employees are considered in the context of a broader shift in strategy. This report:

•• Identifies the structural factors catalyzing change in the retail industry;

•• Examines the current and potential automation initiatives across 30 retail companies, chosen based on market capitalization and comparability;

•• Provides analysis on the characteristics of current retail workers, including gender and location, and assesses stakeholder groups that may be impacted by changes to retail labor;

•• Leverages these insights, using Cornerstone’s BRAVE MatrixTM as well as novel metrics (given the retail sector’s limited disclosure) to analyze how these companies are positioned to manage automation and labor through the industry’s transition; and

•• Provides a set of questions for investors to include in their engagement with retailers.

To download the full report, please click here.