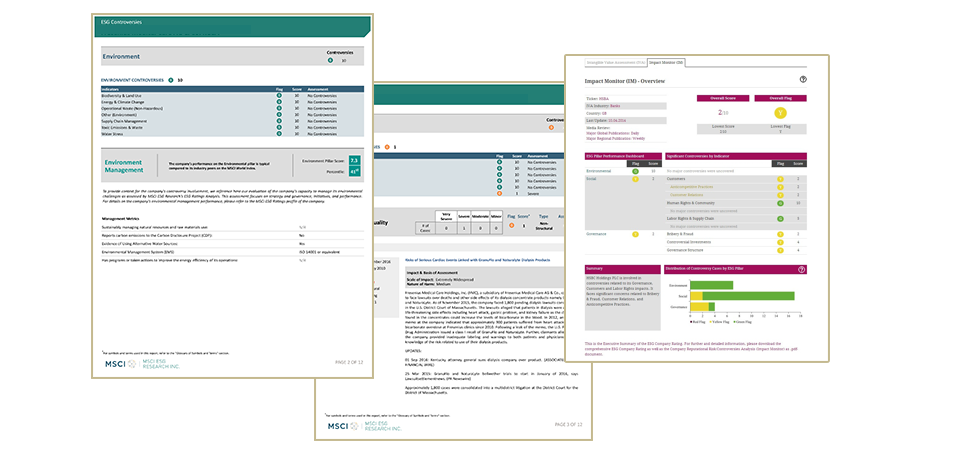

ESG Company Ratings

Based on our partnership with MSCI ESG Research, we’re able to work with comprehensive ESG company assessments and industry leading global coverage. This is important as investors are becoming increasingly aware of the potential risk and value impact on their investments linked with macro ESG trends. yourSRI now enables access to MSCI’s “ESG Company Ratings”, MSCI ESG Rating and MSCI ESG Controveries, covering more than 7,500 Large, Mid and Small Cap companies of the major investment markets worldwide (13,500 issuers including subsidiaries).

MSCI ESG Ratings

MSCI ESG Ratings are designed to help institutional investors understand ESG-driven risk and opportunities and integrate these factors into their portfolio construction and management process.

The global team of 150 research analysts rates over 7,500 companies. The team assesses thousands of data points across 34 ESG issues, focusing on the intersection between a company’s core business and the industry issues that can create significant financial risks and opportunities for the company. Companies are rated on a AAA-CCC scale relative to the standards and performance of their industry peers.

MSCI ESG Ratings Overview

- Data: 1,000 data points on ESG policies, programs and performance

- Exposure Metrics: 80 business segment and geographic risk exposure metrics

- Management Metrics: 129 metrics based on policies, programs, and performance data

- Key Issues Scores and Weights: 37 industry-specific issues weighted based on the industry and the time horizon of the risk / opportunity

ESG Company Ratings are usually updated once within 12 months unless an issue is being discovered that has an impact on the ESG (positive or negative) risk exposure of a company.

The MSCI ESG Company Rating Reports are available on yourSRI.com and cover the whole MSCI universe consisting of MSCI World, MSCI Emerging Markets, MSCI US IMI, MSCI Canada IMI, MSCI Europe IMI, MSCI UK IMI, MSCI AU 200 and MSCI South Africa IMI; therefore covering more than 7,500 Large, Mid and Small Cap companies of the major investment markets worldwide. To learn more about MSCI ESG Research or MSCI ESG Rating, contact FE Fundinfo Client Services or click here.

MSCI ESG Controversies

MSCI ESG Controversies is designed to provide timely and consistent assessments of ESG controversies involving publicly traded companies and fixed income issuers.

MSCI ESG Controversies allows investors to analyze a company’s significant social and environmental impacts and its ability to manage those impacts. Investors are able to determine company involvement in major ESG controversies, how well companies adhere to international norms and principles, and to assess company strategies, disclosure and performance with respect to these norms and principles. It allows investors to determine how well companies adhere to international norms and principles such as the UN Global Compact and ILO Core Conventions.

MSCI ESG Controversies uses more than 30 performance indicators to evaluate the companies, including constituents of the MSCI World Index and all companies on the MSCI ACWI Index. MSCI ESG Controversies notes when companies breach global norms and conventions such as the UN Global Compact and ILO Core Conventions. Company scoring is communicated through a simple ‘traffic light’ code.

Usually, Controversies Reports are updated weekly (in case there is something to report on).

The MSCI ESG Controversies Reports are available on yourSRI.com.To learn more about MSCI ESG Controversies, contact FE Fundinfo Client Services or click here.

Accessing the ESG Company Assessment is easy:

Use our yourSRI-account to access an ESG Company Rating (package including ESG Rating Assessment & ESG Controversies Analysis).